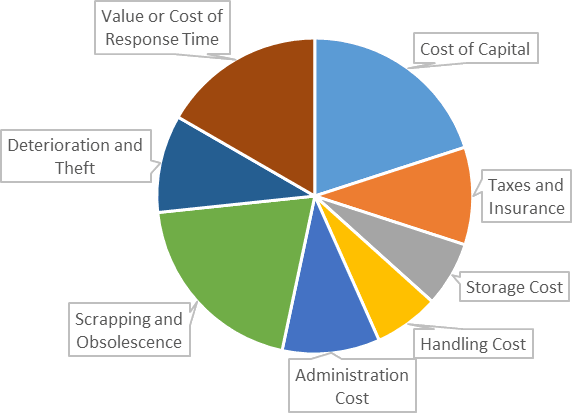

Inventory is one of the seven types of waste. There is usually quite a significant cost associated with having inventory, usually much more than what traditional bookkeeping accounts for. Between 30% and 65% of the value of your inventory is spent every year as inventory-related costs! This post looks into more detail at the cost of this inventory.

Causes of Inventory Cost

Cost of Capital

The first expense associated with inventory is the cost of capital. Simply speaking, the inventory you have represents money, either in the form of raw materials or finished goods that are not yet sold. In any case, you paid for the goods already but have not yet received the return by selling the products. Hence, inventory is tied up cash.

The cost of capital is usually the cost to secure financing (both debt and funds). A (somewhat simplified) example is the interest rate you have to pay for a loan. If you have to borrow $1 million to put it into your inventory, the interest rate would be part of the cost of capital.

The exact number for cost of capital depends on your company, but as of 2014 the average is around 8% (See Cost of Capital by Sector). Typical industry estimates range from 6% to 12% for the cost of capital.

Taxes and Insurance

Besides cost of capital, the goods also have to be insured. Furthermore, they will also be taxed. Details again differ from industry to industry and country to country, but it is estimated that between 3% and 9% are added on top for insurance and taxes.

Storage Cost

The next major cost factor is storage cost. You need to store your goods somewhere. In the simplest case, this may be a stockpile of sand or coal. More sophisticated goods demand protection against the elements, commonly through a warehouse with shelves or storage facilities.

These are not free either. You have to pay for the ground, for the building, and for the maintenance of the building. Of course, this also depends on your location and the type of goods. A warehouse in New York City is simply more expensive than a similar warehouse in rural Kansas.

For example, the cost of storing a pallet in a warehouse is around $17 per month or around $200 per year (not including handling – see the next point for that). Of course, the value of the goods on the pallet varies widely, but $10,000 per pallet is a good estimate . Hence the storage cost in industry is, very roughly, at least 2% of the value of the goods (but it may be up to 5% of the value of the goods) per year.

Handling Cost

Now we know the cost of storing your goods. However, this also requires handling. The goods have to go into storage and get back out again. A common saying in industry is that every time someone touches a package or pallet, it will cost you between $1 and $2.

Now we know the cost of storing your goods. However, this also requires handling. The goods have to go into storage and get back out again. A common saying in industry is that every time someone touches a package or pallet, it will cost you between $1 and $2.

Of course, there are more people involved in the handling of the pallet. Common industry rates start around $3 to $4 for an incoming pallet, and again the same number for an outgoing pallet. Hence the expense is around $8 per pallet moving through the warehouse. Additionally, the pallet is usually moving not only through one but through multiple warehouses. In sum, this also adds between 2% and 5% of the cost of the goods for handling.

Administration Cost

Additionally, there is the administration cost of data entry and bookkeeping. This is also often around $5 per transaction, both for entry and for exit, and again through multiple warehouses.

Additionally, there is the administration cost of data entry and bookkeeping. This is also often around $5 per transaction, both for entry and for exit, and again through multiple warehouses.

Now we would need to know how often the pallet moves through the warehouse. This is called turnover (i.e., the average number of times your inventory is exchanged per year). In manufacturing, turnover is usually not so hot, with an average turnover below two, meaning they have between half a year and one year inventory on hand (Source: What Should the Inventory Ratio Be for Manufacturing?). Automotive is much better with a turnover between five and ten (Source: How Do the 7 Largest Auto Companies Stack Up Against Each Other?).

Assuming a turnover of five would mean that there are five incoming and five outgoing pallets per year for every pallet in storage. As administrative costs are higher than handling, this adds between 3% and 6% of the cost of the goods.

Scrapping and Obsolescence

Both products and raw materials may become obsolete. With increasing volatility and decreasing product life, new products come around even more frequently. If you still have old goods on hand, you can either update them, sell them below cost, or throw them out. In any case, this costs money.

This is often one of the biggest parts of the cost of inventory. It is estimated that obsolescence is between 6% and 12% of the value of the goods. Additionally, this is increasing due to even faster product launches and upgrades.

Deterioration and Theft

Closely related to scrapping cost is deterioration and theft. Products and raw materials may age. This is especially true for perishable goods, but almost every product will deteriorate over time. Glues may get old, metals may rust, electronics may loose their battery life.

Even if they do not deteriorate, they may get dirty. One plant I knew manufactured white panels for housing of electronics and white goods, and then let them sit on the shelves for three months. All of the panels had to be cleaned again by hand since they were so dirty.

Products may also get damaged. Being moved around usually involves the risk of damaging your products. Finally, there is also the issue of theft. Goods may simply go missing. Both deterioration and theft make between 3% and 6% of the value of the goods.

Value or Cost of Response Time

Yet another factor influenced by inventory is the response time. The more inventory you have, the longer your throughput time and the more sluggish your company. Rather than dancing nimbly around your competitors, inventory makes you lag behind. Despite this being the last entry in this list, to me it is the most significant one. Lead times are strongly influenced by inventory, and less inventory means less lead time. This brings you faster to the market. It also accelerates the information flow that moves along with the parts. For example, it reduces the time between a defect occurring and this defect being noticed.

A positive example is Inditex, a Spanish textile manufacturer. Especially for its ZARA brand, they produce in Portugal and Spain. Hence they can deliver the copy of the latest haute couture to their European stores while the competition is still loading in Shanghai.

Another example was during the 2008 economic crisis. For some industries, sales dropped dramatically, but there were still five months’ worth of goods in the pipeline (or on ships). Slowing down the company had five months of lag. All of these products had to be stored somewhere, since they could not be sold. This increased costs even more. Similarly, when the economy increased again, there was another five months lag due to shipping.

Overall, a leaner supply chain makes your company more responsive. It is very difficult to put a value on your companies responsiveness, but I would estimate a cost of at least 5% or 10% of the value of your goods for sluggish response times.

Summary

Overall, the cost of inventory is between 30% and 65% per year! While this differs from company to company, it is not to be underestimated. Some instances even had a cost of inventory in excess of 75%. Below is the distribution for an optimistic case with “only” 30% of the value of the goods as inventory cost per year.

Hence one of the reasons for the success of Toyota in particular and lean manufacturing in general is the realization of the cost of inventory. You are effectively paying between 1/3rd and 2/3rd of your inventory every year! I hope this motivates you to reduce your inventory. Now go out and improve your Industry!

Source

(unless linked above):

Richardson, Helen: Control your costs–then cut them. Transportation & Distribution; Dec 1995, Vol. 36 Issue 12, p. 94

1 thought on “The Hidden and not-so-hidden costs of Inventory”